Complete Guide to Understanding ACH Payments for Dispensaries

In the fast-growing cannabis industry, cash has remained the dominant mode of payment for many retailers. However, relying solely on cash transactions poses significant challenges for cannabis businesses.

The prevalent use of cash in the industry not only makes managing cash flow more challenging but also increases the dispensary's vulnerability to theft and security risks.

Fortunately, there is a solution that can alleviate these concerns and revolutionize payment processing for cannabis retailers — ACH payments for cannabis.

Cannabis ACH payments provide a reliable and secure electronic funds transfer system that allows cannabis businesses to send and receive payments digitally. By embracing ACH payments for cannabis retailers, dispensaries can not only streamline their payment operations but also enhance cash flow management and reduce the risks associated with cash handling.

In this guide, we will explore the ins and outs of ACH payments for cannabis retailers, delving into their benefits, various types, working mechanisms, processing times, safety considerations, and more.

Let’s dive right in!

What are cannabis ACH payments?

ACH payments, also known as Automated Clearing House payments, are electronic funds transfers that facilitate secure and efficient transactions between financial institutions. This system enables businesses and individuals to send and receive payments digitally, eliminating the need for physical checks or cash.

ACH payments for cannabis are so relevant in the industry due to the unique challenges faced by businesses operating in this sector.

The federal illegality of cannabis has resulted in limited access to traditional banking services, making it difficult for dispensaries to establish relationships with financial institutions.

As a result, many cannabis retailers have been forced to rely primarily on cash transactions, which can be inconvenient and risky.

By leveraging ACH payments, dispensaries can enhance their operational efficiency, improve cash flow management, and provide a seamless payment experience for their customers.

Furthermore, ACH payments for cannabis e-commerce align with the growing trend toward a cashless society. As consumers increasingly prefer digital payment methods, offering ACH payment options allows cannabis retailers to meet customer expectations and remain competitive in the evolving marketplace.

In the upcoming sections, we will explore the different types of ACH payments and how they can be utilized in the cannabis industry to facilitate secure and efficient transactions.

What are the different types of ACH payments?

ACH payments encompass two primary types: direct deposit and direct payment. Each type serves distinct purposes and offers unique benefits within the domain of electronic funds transfers.

1. ACH Direct Deposit

Direct deposit is an ACH transaction initiated by the payer to send funds directly to a receiving account. This type of ACH payment is commonly used for various purposes, including:

- Payroll: Employers utilize direct deposit to transfer wages or salaries to their employees' bank accounts, providing a convenient and efficient method for distributing compensation.

- Reimbursements: Direct deposit allows for the direct reimbursement of expenses incurred by employees, streamlining the reimbursement process and eliminating the need for physical checks.

- Government Benefits: Many government agencies use direct deposit to distribute benefits such as social security payments, tax refunds, and other financial assistance directly into recipients' bank accounts.

- Pension and Annuity Payments: Direct deposit enables retirees to receive regular pension or annuity payments electronically, ensuring a seamless flow of funds.

2. ACH Direct Payment

Direct payment refers to an ACH transaction initiated by the recipient to request funds from a payer's account. This type of ACH payment facilitates the automatic collection of payments for recurring bills, subscriptions, and other financial obligations.

Some key aspects of direct payment include:

- Bill Payments: Individuals and businesses can set up direct payment arrangements to authorize automatic payments for bills, such as utilities, rent, mortgages, insurance premiums, and credit card bills. This eliminates the need for manual payments and reduces the risk of late or missed payments.

- Online Purchases: Direct payment enables online retailers to accept payments directly from customer's bank accounts, providing an alternative to credit cards and other traditional payment methods.

- Peer-to-Peer Transfers: Popular peer-to-peer payment platforms like Venmo and Zelle utilize ACH direct payments to facilitate instant fund transfers between individuals.

In both direct deposit and direct payment transactions, the ACH Network processes the electronic transfers securely and efficiently, ensuring the seamless movement of funds between accounts.

By understanding the different types of ACH payments for cannabis, retailers can leverage the electronic payment system effectively, providing greater convenience and security for customers.

What are the benefits of ACH payments for cannabis?

The cannabis industry is evolving rapidly. And it’s crucial for businesses to adopt modern cannabis payment services for providing a competitive retail experience.

ACH payments offer numerous benefits for cannabis businesses, allowing them to overcome the limitations of cash transactions and enhance their operations.

Let's explore some of the key advantages of implementing ACH payments for cannabis retailers:

1. Improved Security

Cannabis dispensaries have often faced security concerns due to the nature of operating as cash-only businesses.

However, by implementing ACH payments, dispensaries can enhance security and mitigate risks associated with handling large amounts of cash.

ACH transfers provide a safe and traceable digital payment method, reducing the vulnerability to theft and promoting a safer business environment.

2. Increased Revenue

Implementing cannabis ACH payments can lead to a boost in revenue for cannabis retailers. Research indicates that dispensaries offering cashless payment options experience an average increase of 20% in order value.

With digital payments, dispensaries can leverage upselling and cross-selling techniques more effectively, as customers are more inclined to explore additional products or services when making convenient electronic transactions. This drives higher sales volume and overall profitability.

3. Reduced Customer Wait Times

One of the significant benefits of cashless payments is the reduced wait times for customers. By transitioning to ACH payments for cannabis, dispensaries can streamline the transaction process, resulting in quicker checkout experiences.

Studies in the broader retail industry indicate that cashless payment alternatives correlate with up to a 15% increase in the number of transactions processed per hour. This improved efficiency enhances customer satisfaction and contributes to a positive dispensary experience.

4. Convenience and Cost Savings

ACH transfers offer convenience and cost savings for both businesses and customers. Making recurring payments, such as utility bills or monthly expenses, through electronic ACH payments is more efficient and less time-consuming than writing and mailing physical checks.

It eliminates the need for purchasing stamps and reduces administrative tasks. Additionally, ACH transfers are often free or involve minimal fees, making them a cost-efficient alternative to wire transfers or other payment methods.

In the case of cannabis businesses, subscriptions are not very popular. Convenience and cost savings for both businesses and customers can be offered through savings on ATM fees and bank charges associated with using an ATM outside of the bank's preferred network of machines. And convenience can be offered in the form of offering the freedom to be able to spend as much as is available in their bank account without needing to hold it or withdraw it in cash.

For businesses, cost savings include savings on cash transportation services or the danger of transporting cash.

5. Quick Settlement

Cannabis ACH payments facilitate prompt settlement of transactions. The funds transferred via the ACH Network typically settle within one to two business days, ensuring fast and reliable payment processing.

This quick settlement benefits cannabis retailers by improving cash flow management and reducing the time gap between transactions and funds availability.

How do ACH payments for cannabis work?

Let's explore the step-by-step process of ACH payments.

In ACH payments, two key entities are involved: the originator (the payer) and the receiver (the payee). For cannabis transactions, the originator is typically the customer, while the receiver is the cannabis retailer or dispensary.

1. Initiating the Transaction

Suppose a customer, let's call them "Green Leaf," wishes to make a purchase from a cannabis dispensary. Green Leaf approaches its bank, which serves as the Originating Financial Depository Institution (ODFI).

At the ODFI, Green Leaf provides the necessary information for the ACH payment, including the cannabis retailer's bank account details, such as the routing number and account number.

2. Submitting ACH Files

Once Green (ODFI) has gathered the required information, they create ACH files. These files contain specific specifications and formats, primarily including the retailer's bank information and the transaction amount. These ACH files are crucial for facilitating the secure transfer of funds.

3. Debiting the Originator's Account

The ODFI proceeds to debit Green Leaf's account for the specified transaction amount. This step ensures that the funds are allocated for the ACH payment and ready for transfer.

4. Routing the ACH Files

At the end of the day, the ODFI aggregates all the ACH files generated throughout the day. These files are then sent to the ACH network, which is typically facilitated by entities like the Federal Reserve. The ACH network acts as a central hub for processing and routing ACH transactions.

5. Processing at the Receiving Financial Depository Institution (RDFI)

Once the ACH files reach the ACH network, they are sorted and directed to the cannabis retailer's bank, known as the Receiving Financial Depository Institution (RDFI). The RDFI receives the ACH files related to the specific transaction and begins processing them.

6. Crediting the Receiver's Account

Upon processing the ACH files, the RDFI credits the cannabis retailer's account with the transaction amount, in this case, the funds are deposited into the retailer's account. This ensures that the retailer receives the payment for the cannabis purchase made by Green Leaf.

It's also essential to note that this process can also be reversed if the cannabis retailer needs to issue a refund or if there are insufficient funds in the customer's account. In such cases, the RDFI processes a return ACH file, indicating the return of funds and providing a reason code for the transaction error.

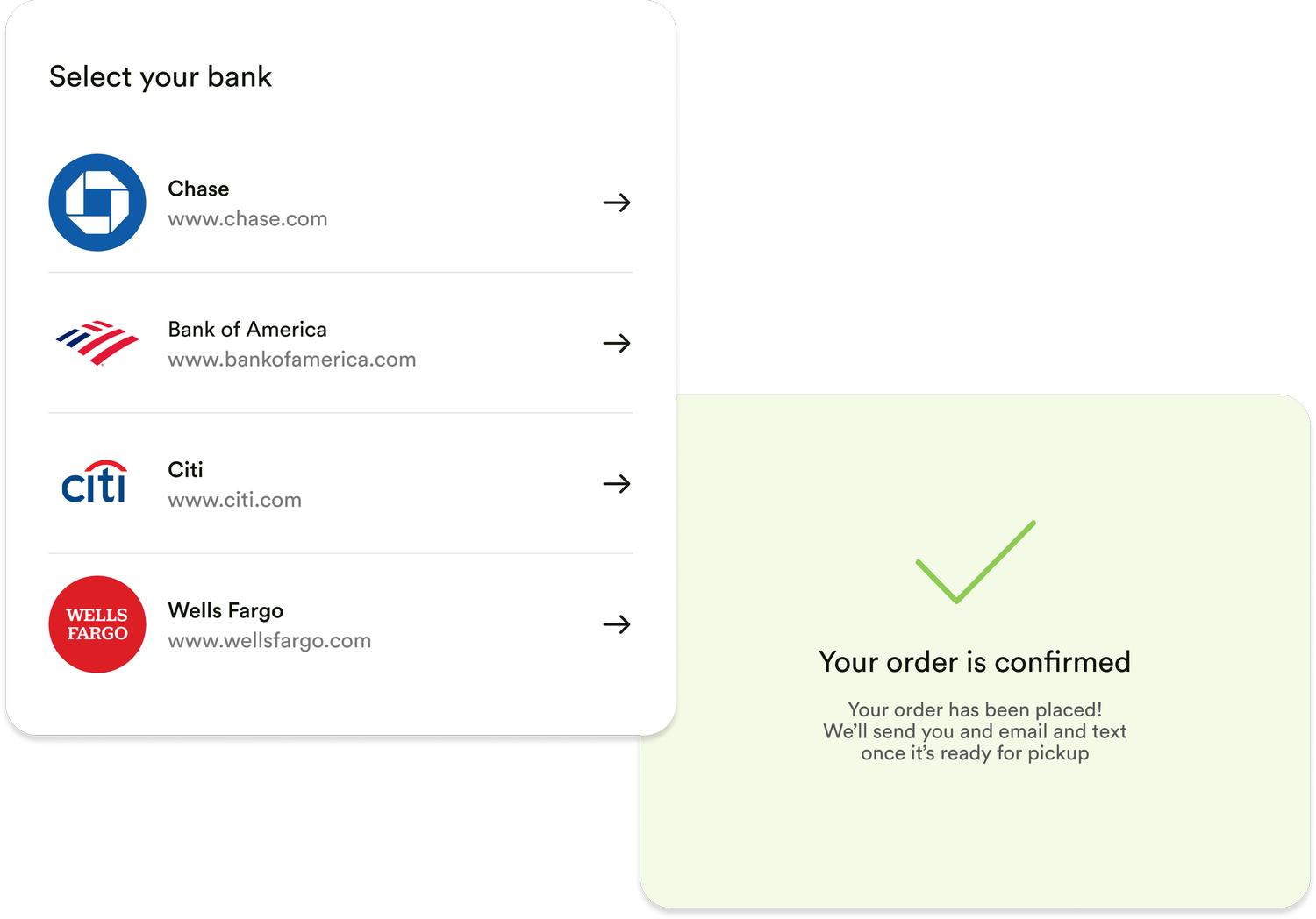

When you use ACH payments at your dispensary or retail outlet, the customer experience includes connecting their bank once (scanning a QR code or navigating somewhere to sign up) and then for each subsequent time, just tapping an option on a point of sale system. This enhances their buying experience with your dispensary as well.

Are ACH payments for cannabis safe?

When it comes to financial transactions in the cannabis industry, safety and security are of paramount importance. Fortunately, cannabis ACH payments offer a secure and reliable payment method for cannabis dispensaries and customers.

The ACH network facilitates these transactions and is highly regulated and subject to stringent oversight. This means robust fraud protections and security measures are in place to safeguard the interests of both parties.

Encryption protocols, secure transmission channels, and verification processes are employed within the ACH network to mitigate risks and ensure safe transactions.

Cannabis payment processing providers also play a crucial role in enhancing the safety of ACH payments. These providers invest in advanced fraud detection systems, real-time monitoring, and compliance with industry-specific regulations.

By partnering with a reputable cannabis payment services provider, businesses can ensure an additional layer of security for their financial transactions.

Even for customers, ACH payments provide peace of mind knowing that their sensitive financial information is protected during transactions. Personal data, such as bank account numbers and routing numbers, are securely transmitted and stored within the ACH network.

What is the processing time for ACH transactions?

While ACH transfers offer a convenient and secure payment method, it's essential to be aware of the timeframes involved.

Let's delve into the processing times for ACH transactions within the cannabis industry.

Delivery Time for ACH Transfers

ACH transfers typically take several business days for delivery. It's important to note that business days refer to days when banks are open, excluding weekends and holidays. Unlike wire transfers that can be processed in real-time, ACH transfers are processed in batches, which occur only seven times a day.

ACH Credit Transfer Speed

For ACH credit transfers in the cannabis industry, financial institutions have the flexibility to choose between two options:

- Same-Day Processing and Delivery: Some institutions may opt to process and deliver ACH credits within the same day. This allows for faster availability of funds to the recipient.

- One to Two Business Days: Alternatively, financial institutions may adhere to the standard ACH credit processing timeframe of one to two business days. This means that the funds will be credited to the recipient's account within this timeframe.

ACH Debit Transfer Speed

In contrast to ACH credit transfers, ACH debit transactions in the cannabis industry must be processed by the next business day. This ensures the timely deduction of funds from the payer's account and helps maintain efficient financial operations.

Total Delivery Time and Variations

While the National Automated Clearing House Association (NACHA) sets rules and guidelines for ACH transactions, it's essential to consider that individual banks and credit unions may also hold transferred funds for a certain period. This can vary depending on their internal processes and policies, thus affecting the overall delivery time of ACH transactions.

Expediting Payments and Bank Charges

NACHA rules ensure that banks have the capability to process ACH payments on the same day they are sent. However, whether a bank charges customers for expediting a payment is at the bank's discretion. Some banks may offer expedited processing for an additional fee, while others may not charge any extra cost.

Collaborating with a reputable cannabis payment processing provider or utilizing specialized cannabis payment services can help streamline the ACH payment process and ensure timely fund transfers within the cannabis industry.

What is the cost of ACH payments for cannabis?

ACH payments offer a cost-effective solution for businesses in the cannabis industry to process payments digitally and reduce reliance on cash transactions.

The cost of ACH credit transfers, which involve sending money between accounts at different banks, can vary. Some banks may charge a nominal fee of around $3 for these transfers, while others offer them for free as part of their services.

In most cases, there are no fees for receiving ACH credit transfers, making it a convenient and affordable option for cannabis businesses to receive payments from customers.

On the other hand, ACH debit transfers, such as payroll direct deposits and bill payments, are typically free of charge. This means that cannabis dispensaries can facilitate direct deposits for employee wages and accept bill payments from customers without incurring additional costs.

However, if there is a need for expedited bill payments or person-to-person payments initiated through third-party apps like PayPal, there may be small fees associated with these transactions. The specific fees can vary depending on the platform and payment method chosen.

With the help of cannabis payment processing providers offering ACH payment capabilities, dispensaries can streamline their payment processes and reduce the financial burden of cash transactions.

Cannabis businesses should explore different cannabis payment services and compare their fee structures to find the most suitable and affordable option for their specific needs.

What is the difference between ACH payments and wire transfers?

When it comes to transferring funds electronically, two commonly used methods are wire transfers and ACH payments.

While they both serve the purpose of transferring money from one account to another, there are key differences between the two.

1. Speed and Timing

Wire transfers are known for their immediate or same-day delivery, making them ideal for urgent or time-sensitive transactions. On the other hand, ACH payments are processed in batches, and it typically takes several business days for the funds to be transferred. This difference in processing time is due to the varying operational procedures of wire transfers and ACH payments.

2. Cost

Wire transfers are generally more expensive, as they involve a direct and immediate funds transfer between banks. Banks often charge fees for both sending and receiving wire transfers, which can vary depending on the amount and destination of the transfer.

On the contrary, ACH payments are usually more cost-effective, with lower or no transaction fees involved. This makes ACH payments a more affordable option for businesses and individuals, particularly for recurring or non-urgent transactions.

3. Accessibility and Convenience

Wire transfers typically require individuals or businesses to visit a bank or financial institution in person to initiate the transfer. This can be a time-consuming process, especially if there are additional forms and documentation required.

ACH payments, on the other hand, offer greater accessibility and convenience. They can be initiated online or through automated systems, allowing users to initiate transactions from the comfort of their homes or offices.

This convenience makes ACH payments a popular choice for regular bill payments, subscription services, and other recurring transactions.

4. Usage and Purpose

Wire transfers are often used for high-value transactions or international transfers, where immediate and secure transfer of funds is crucial. They are commonly utilized for large business transactions, real estate purchases, and international remittances.

On the other hand, ACH payments are more suitable for domestic transactions and recurring payments. They are widely used for payroll processing, vendor payments, subscription services, and online purchases within the same country.

Long story short, go with ACH payments for your cannabis business!

Conclusion: It’s time to embrace ACH payments in cannabis

Embracing ACH payments for your cannabis business can provide numerous benefits, such as improved security, boosted revenue, and reduced customer wait times.

By transitioning from a cash-only model to accepting digital payments, dispensaries can enhance the overall retail experience, increase sales volume, and mitigate the risks associated with operating an all-cash business.

Implementing a reliable cannabis point-of-sale (POS) system is crucial to facilitate ACH payments and encourage cashless transactions. One such enterprise-grade POS system is Treez.

With Treez, cannabis businesses can seamlessly integrate ACH payment capabilities into their operations, offering customers a convenient and secure way to make purchases.

By utilizing the features and functionalities of a robust cannabis POS system like Treez, dispensaries can streamline their payment processes, enhance compliance, and improve overall business efficiency.