Massachusetts is at a Crossroads. Will it Break the Saturation Cycle?

For years, Massachusetts cannabis retailers have been on a ride – yanked along the ups-and-downs of what has become the classic cannabis industry roller coaster, but with the volume turned up.

In 2020, like many other legal markets, Massachusetts saw a surge in sales due to increased consumption during the pandemic, the essential worker status granted to most dispensaries, and individuals having more disposable income from unemployment benefits.

The situation changed in the summer of 2021 as the world began to reopen, leading to intensified competition for consumer spending. Legal cannabis sales declined, causing cash shortages, staff layoffs, and increased debt for operators.

By 2022, the Massachusetts market was flooded with an oversupply of cannabis, sending prices plummeting. This surplus coincided with inflation in the overall US economy, adding to the financial strain on retailers and eroding profit margins.

In just a year, the Massachusetts wholesale market saw a 58% reduction in price, dropping from $3,387 per lb in Jan. 2022 to $1,416 per lb in Jan. 2023. As NBC Boston reported at the beginning of April, the amount consumers pay for legal cannabis in Massachusetts is at a five-year low. Cannabis Business Times cited April numbers from the Massachusetts Cannabis Control Commission which say the average flower price at adult-use retail at $171.60 per ounce, a 57% decrease from early 2021.

This drastic decrease in prices created inflationary pressures and increased costs for producers. With margins squeezed, operators have had to find ways to navigate these challenges and ensure the sustainability of their businesses. It's important to note, however, that this correction in the market may not necessarily reflect a decrease in demand for cannabis products. Rather, it could be seen as a necessary adjustment following the extraordinary sales seen during the peak of the pandemic.

The challenges in the Massachusetts market have recently prompted Trulieve, a multi-state operator, to announce its decision to exit the state. Citing slower retail sales growth, Trulieve said it will be closing its three retail facilities in Mass. by June 30, 2023 and shuttering its cultivation and processing facility by the end of the year.

Massachusetts Operators: Act Quickly Or Face Oversaturation

In our industry-wide market grade analysis, we placed Massachusetts firmly in the Saturated category and awarded it a grade of C+. Saturation of the market (too much cannabis supply, not enough demand to support it) and a race to the bottom in pricing have become key concerns. In order to survive, as we said in our article, Massachusetts operators need to make adjustments to their operating procedures and processes to regain growth and profitability. We believe there is still hope for them to succeed if they act quickly.

After watching missteps in markets like California and Colorado, operators in Massachusetts know that the time for better solutions and operational workflows is now. While some may look at technology partners as cost centers and look to reduce that cost, the operators who will succeed in these tough markets recognize the value of POS companies, both as revenue sources and hubs for operational optimization.

Instead of cutting corners, Treez encourages operators to recognize the importance of operational optimization and the use of sophisticated systems to get out from underwater.

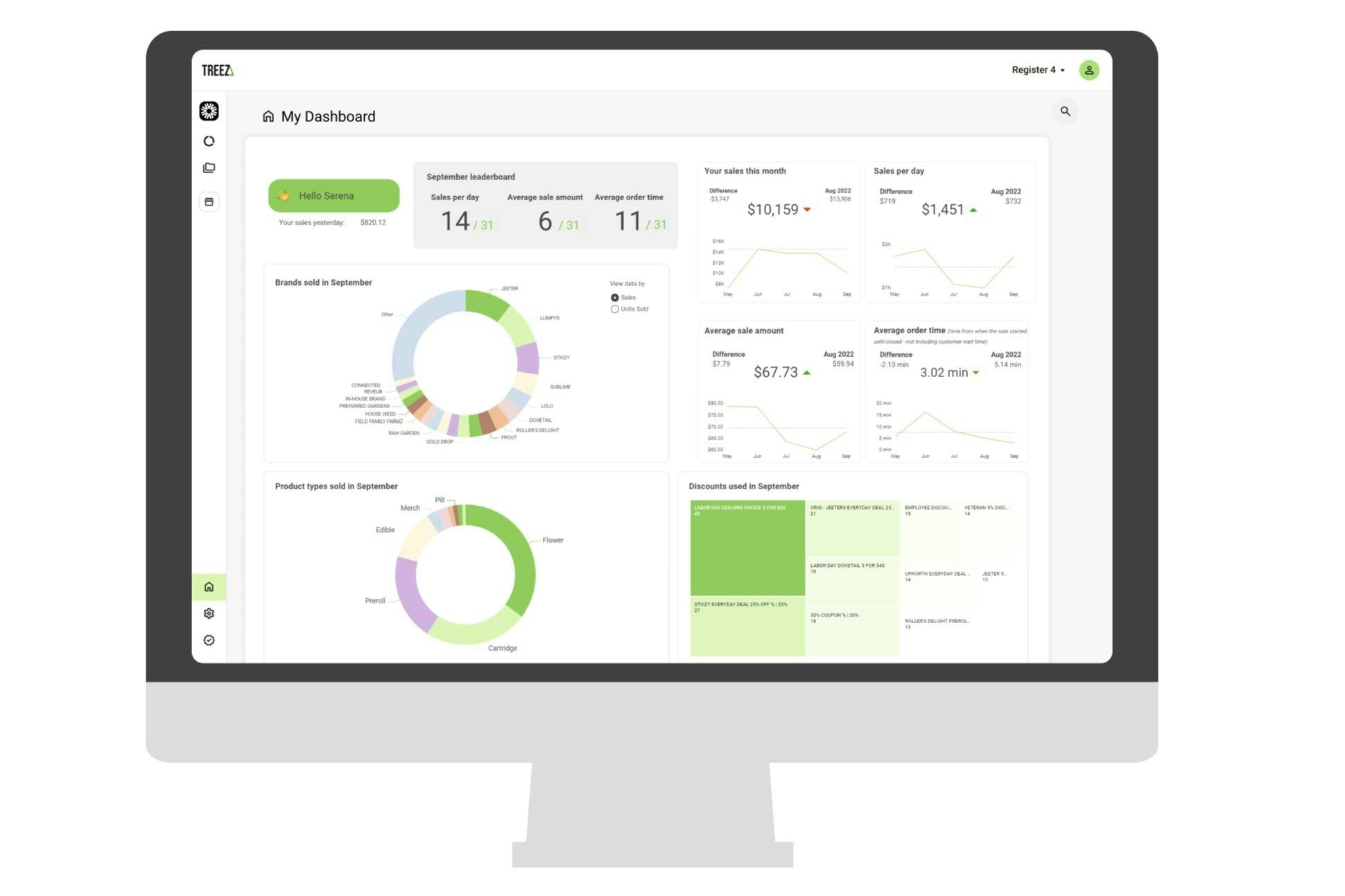

With a quality system like Treez, Mass. operators unlock:

- Actionable insights that lead to better business decisions

- Savings on employee and management work hours

- Fewer products expiring on shelves thanks to sellable velocity

- Higher AOV and fewer abandoned pickup orders through cashless payments

- Enhanced customer experience and more repeat purchases through loyalty programs

- Improved confidence on which products to stock based on which products are selling well

- Better insights into which budtenders are performing most effectively

- Clarity into which discounts are generating results

In the earlier days of the Massachusetts market, operators had so many decisions to make and tasks at hand. Some adopted technology solutions that were cheap, without the enhanced features like data and insights to optimize their operation. Now that the state is facing a down market, operators are finding that “good enough” isn’t sufficient. Unrefined reporting that requires hours of manual work and the reconciliation of hundreds of reports is no longer acceptable.

With platforms like Treez's Retail Analytics, operators can access the data on each major facet of their business, directly within their point of sale system or on-the-go. Armed with this knowledge, operators can optimize their product offerings and promotional strategies quickly and easily, ultimately improving their bottom line.

The Massachusetts cannabis market has experienced its share of ups and downs. From the boom in 2020 to the challenges faced in subsequent years, the industry has undergone significant changes. But with the right tools and strategies, we know Mass. operators can shake these difficulties and set their businesses on the road to sustainable growth and profitability.

If you are a Massachusetts operator seeking to break the saturation cycle, join us at the Flower Expo on June 14 and June 15, 2023 from 10 am to 5 pm to connect with industry leaders. Visit Treez at Booth A6 to explore Retail Analytics’ capabilities and get access to the valuable tools necessary to thrive in a tough market.